List of Top 10 Payment Gateways in India

This consolidated list contains a list of 10 major payment gateways in India. Only the best and state-of-the-art applications have been discussed in detail. Now, without much ado, let us enter the details.

1. CCAvenue

CCAvenue is the biggest payment gateway in South Asia. And, definitely one of the most reliable payment gateways in India. This gateway ensures highly optimized success rates, quality of sales report and aggressive pricing to support owner’s business model. In order to showcase its specialty, we have analyzed each and every feature of this brilliant payment gateway. At the time of writing, CCAvenue has the following features.

- Integrated payment gateway

- Supports 6 credit cards namely Visa, MasterCard, American Express, JCB, Diners Club and EZE Click

- Two interfaces: Variable Amount Interface and Shopping Cart Interface

CCAvenue Payment Gateway Charging and Setup Cost in India: The gateway offers two types of service to its consumers. One is STARTUP PRO and the other one is PRIVILEGE.

Setup Cost and Other Charges for STARTUP PRO:

- ZERO setup cost.

- Annual Software Upgradation Charges are INR 1200. A.S.U.C is applicable on 1st April every year.

- Transaction Discount Rate (TDR) is 2% for the following services:

- All Master Cards and VISA Credit Cards (Domestic)

- EMI options of 8 major banks namely Axis, SBI, HDFC, ICICI, Kotak, IndusInd, HSBC, and Central Bank of India

- MasterCard, VISA, Maestro, and RuPay and more than 100 debit cards support.

- 53+ Net banking.

- ITZCash, PayCash, ICash, and Oxicash – these 4 cash cards.

- 8 wallets which include major wallets like Paytm, Freecharge, Mobikwik, SBI Buddy and few others.

- IMPS (46 banks)

- Transaction Discount Rate (TDR) is 3% for the following services:

- All International Master Cards and VISA Credit Cards

- American Express/Amex EMI, JCB & Diner’s Club

- Transaction Discount Rate (TDR) is 4.99% for 27 Multi-currency options.

Setup Cost for PRIVILEGE:

- One-time INR 25,000 (Now, earlier it was INR 30,000)

- A.S.U.C is not applicable for PRIVILEGE owners.

- TDR for this setup is personalized and of competitive rates. After the completion of registration, the executives of CCAvenue handles everything through proper communication.

The following features are free for both Startup Pro and Privilege owners.

- Invoice payments.

- Multiple currency processing.

- Easy customization

- Smart Dynamic Routing

- Retry option

- CCAvenue checkout and Shopping Cart Plugins

- iFrame Integration

- Responsive Checkout page

- Marketing tools

- CCAvenue Brand 360 degree

- CCAvenue S.N.I.P (Social Network In-stream Payments)

- Smart Analytics

- Dynamic Event Notification

- CCAvenue F.R.I.S.K (Fraud and Risk Identification Knowledgebase)

- Super Customer Support

Few other major features of CCAvenue are as follows:

- There are no withdrawal fees.

- Safe Card Storage Vault that helps customers to save and recall their card details that have been entered on their merchant’s website.

- 24X7 customer support through voice, email, and chat.

- CCAvenue settles all payments on a weekly Minimum INR 1000 must be kept.

- More than dozens of shopping carts, CCAvenue is the most preferred They have developed the CCAvenue Integration API for these major 3rd party shopping carts like BuildaBazaar, WordPress, Drupal, Magento, Joomla, ZenCart, PrestaShop and many more.

- A number of documents are required to access CCAvenue. Here goes the list.

- Usually, an account gets activated right after the 1 hour of registration. To have complete access, it may take from 3 to 6 days. CCAvenue checks the merchant’s website and verifies every hard copy and soft copy.

Android, iOS, and Windows – CCAvenue can be accessed through any of these 3 mobile apps

Some of the major clients of CCAvenue:

MakeMyTrip, Yatra, Air Asia, Myntra, Jabong, Shopclues, Snapdeal.

2. Easebuzz

Easebuzz is one of the most intuitive and efficient payment gateways with a strong emphasis on digital payment all across the globe through different mediums such as credit card, debit card, UPI, net banking, etc. Easebuzz comes with a boatload of state-of-the-art features that can make a transaction immensely easy like Easy API, 100+ Payment options, and QR Code-based payment.

At the moment, the payment gateway provider has more than 15000 clients all over the world, according to them. Furthermore, the organization is tied up with India’s leading financial institutions, private banks, and wallet companies. Moreover, they are compliant as per the RBI policies.

Supported Cards and Wallets

- RuPay

- Master Card

- Maestro

- Visa

- Dinners Club

- Discover

- Paytm

- MobiKwik

- Airtel Money

- Idea Money

- Ola Money

- JioMoney

- And Many More…

Settlement Cycle

The settlement cycle of Easebuzz is another aspect that can stimulate you to avail their service. They settle all the card transactions in T (date of transaction)+1 working days and the wallet transaction as well as Net Banking is settled within T+3 working days.

Features of Easebuzz

The following features of Easebuzz make the Easebuzz one of the best payment gateways in India and make it immensely intuitive and unique for the individuals who need a digital payment solution for their websites and applications. Let’s have a look at the features.

- Online Order Tracking

- Invoice Generation

- End to End Encryption

- PCI DSS Compliant

- 99% Transaction Success

- Supported by India’s No.1 Private Bank

- Transaction Report Download

- Customer Purchasing Behavior Detection

- Online KYC Process

- Required Details: PAN Card and Bank Details

- Attractive Referral Programs

- Availability of Social Media Plugins for Faster Promotion

- Payment Gateway Pages are Customizable

- Integrated Email and SMS Marketing

- Availability of Easy Payment Link

- GST Compliant Invoicing

- Customized MPR Report

Pricing Details – Simple and Transparent

Below are the pricing details of Easebuzz. The pricing is lucrative and industry-focused. Have a look at the pricing plan.

Pricing Plan

| Debit Cards | Credit Cards | Net Banking | Cash Card or Wallets | Debit Card with ATM Pin | UPI |

Micro

| 1.5% | 2.3% | 2.2% | 2.5% | 1.5% | 1.5% |

| Enterprise | 1.1% | 2.1% | 2.1% | 2.4% | 1.1% |

1.1%

|

| Education | 1.2% | 1.5% | 25 INR | – | – |

25 INR

|

Setup cost for large and medium size businesses are completely free when you avail Easebuzz. Also, there will be no hidden charges associated with Easebuzz. Moreover, you will get a customizable pricing based on your business category.

2. Instamojo

Instamojo is the one-stop solution for every other MSME in India. It is the easiest and simplest payment gateway. This gateway can be integrated into any website. Instamojo offers the simplest API with detailed documentation. At this point in time, Instamojo has these following features which are quite brilliant.

- Integrated payment gateway.

- Setup charge and Maintenance charge both are INR 0 or Free. There is no minimum commitment.

- It supports domestic Debit cards and Credit cards of over 58 banks. EMI options are available only for top banks.

- The Transaction fee is quite reasonable and competent: Flat @2% + INR 3 per transaction for all Debit and Credit cards. The rate is same for the mobile wallets as well. Mobikwik, Freecharge, JioMoney, and OlaMoney these 4 are supported by Instamojo.

- For digital file hosting and download the Transaction Fee is @5% + INR 3 per transaction.

- International Credit Cards and American Express Cards are all available on request.

- Right now, multi-currency is not supported. Only Indian currency i.e. Rupee is supported.

- There are no withdrawal fees, same like CCAvenue which is quite competent from the marketing point of view.

- Intamojo claims to take maximum 3-5 minutes of time to get started which is definitely great. They do charge any legal cost for documentation and developer costs for integration.

- Settlement days are 3 days approximately.

- It supports major eCommerce CMS (Content Management System) like Drupal, WordPress, Magento, PrestaShop etc.

- Mobile app integration is available for both Android and iOS.

- Once owner signs up, they send all the details.

- Copy-paste payment buttons, online store, fraud protection, in-built dispute resolution, transaction failure prevention, a weekly performance report on email, real-time sales reporting, payment links, integration with SMS, integration with WhatsApp and integration with Social media everything is included in a single zero cost account.

These features undoubtedly make Instamojo one of the leading payment gateways in India.

3. EBS

EBS or E-Billing Solutions which is a part of Ingenico Group is the first ever Indian Payment Gateway that has achieved the new PCI DS 3.0 standards of compliance. By using SSL software, they ensure the data security of consumers which makes them perfect as a payment gateway. EBS is certified and audited by ISO 27001-2013 standard. And these things make EBS one of the safest payment gateways in India and in the world.

Right now, EBS is proving two plans namely Starter and Premium.

Starter Plan

The list below contains every attribute and pricing information about Starter plan.

- Right now, for promotion purpose, they have waived off the setup cost and so it is INR 0 i.e. free.

- Credit cards (VISA, MasterCard)

- Debit Cards (Mastercard, Maestro, RuPay, VISA)

- Net banking system with over 40 banks. TDR 2%

- EMI on Credit cards (9 major banks)

- IMPS and UPI

- Amex, EzeClick, Diners, Wallets, Cash cards (TDR is 3%)

- Payment page customization.

- Plugins for all major shopping carts.

- Turbo checkout.

- AutoPay

- Intuitive Analytics

- Payment Page Rendering

- Friendly customer support (off on weekends)

For Premium plan, setup cost and TDRs are available on request.

Key Features of EBS

Here is the list of some key features of EBS.

- The first year, the Annual Maintenance Charge is zero, from the 2nd year it becomes INR 1200.

- Multi-currency support. Supports 11 major foreign currencies.

- Dynamic Currency conversion, that attracts consumers across the globe.

- It supports wallets like Oxigen, Mobikwik etc.

- On request, EBS provides these services which are NEFT/RTGS, Mobile SDK, Mobile Currency Gateway, Invoice payments, IVRS, Split Payments, Foreign Cards.

- The Withdrawal Fee is Zero.

- Settlement days are usually 2 to 3 days.

- Owners can go Live just within 24 hours.

- Mobile app integration for Android, iOS, and Windows.

- EBS has developed API for major shopping carts used by most of the merchants namely Magento, OpenCart, PrestaShop, WordPress, Joomla, and Zen Cart.

4. PayPal

When the topic revolves around the best payment gateways in India, PayPal is an obvious name. This global payment gateway is available for more than 200 countries and supports more than 100 currencies. If merchants have international consumers, then PayPal must be integrated. PayPal also enables merchants to withdraw funds in 56 currencies and hold their balances in their PayPal accounts in 25 currencies.

PayPal believes that you should only pay TDR when you get paid. The transaction fee per transaction works as follows at the time of writing.

- For Local Transaction: 2.5% + fixed fee INR 3

- For International Online Transaction (except eBay payments):

- 4% + fixed fee based on the currency (Upto $3000 USD)

- 9% + fixed fee based on the currency (Upto $3001.01- $10,000 USD)

- 7% + fixed fee based on currency (Upto $10,000.01 – $100,000 USD)

- 4% + fixed fee based on currency (Over 100,000.01 USD)

Right now, PayPal is offering two plans for PayPal Payment Gateway. Payflow Link and Payflow Pro. Payflow Link is a basic plan.

The service charges of Payflow Link are:

- No setup cost.

- No monthly fee.

- No termination fees.

- No Annual Maintenance Charge

- $0.10 per transaction at the time of writing.

- Checkout hosted by PayPal.

The service charges of Payflow Pro are:

- $25 monthly fee plus GST/HST

- $99 setup fee.

- $0.10 per transaction at the time of writing.

- Unlimited checkout customization.

Other Key Features of PayPal

Following are the other key feature you will discover in PayPal. These are the reasons why the payment gateway has managed to garner so much of audience and users.

- On request, PayPal offers additional fraud protection services, recurring billing, and buyer authentication.

- PayPal is widely used by Indian merchants to receive International payments. It does not recognize Indian currency. So, it works in this way. For example, you want to receive a payment that is in British Pound. So, PayPal would, at first, convert it into US Dollar. So, when you will withdraw the money, PayPal will charge you a currency conversion fee to convert that USD to INR at your bank.

- There are no withdrawal fees for PayPal. But, merchants need to have FIRC or Foreign Inward Remittance Certificate. FIRC acts as a testimonial for every inward remittance and payments received in Indian from abroad. No need to worry, because PayPal has made it easy for the owners. They offer two options to get FIRC. One is Electronic Request and Payment and the other one is Demand Draft based Request and Payment. Give all your details to them. Citibank team would verify everything. After that, they would dispatch the advice to the respective bank address. Finally, you need to collect the document that is FIRC advice/certificate from your bank.

- PayPal offers a very simple documentation process. The process consists of only 4 steps.

- Verify PAN card instantly.

- Confirm email ID.

- Add a bank account for payment proceedings.

- And lastly, select the purpose code that describes your business transactions properly. And you are good to go Live.

- No settlement days, all payments can be auto-withdrawn to the respective banks on daily basis.

- PayPal REST API is easy for any online transaction including mobile payments. This API is HTTP-based that uses OAuth 2.0 for authentication. However, the use of this API is restricted for credit card payments. For credit card payments, you can use Braintree Direct.

- Right now, PayPal mobile app is available on Android, iOS, and

- PayPal has a brilliant list of partners. The list includes Zoho, Magento, Shopify, WooCommerce.

5. Atom Paynetz

At this point in time, Atom Payment Solution is one of the leading payment gateways in India. It has over 265 payment options and more than 100,000 merchants associated with it.

Right now, Atom is providing two plans namely Standard plan (Solely for SME and Startup) and Enterprise plan. Both the plans have the same Annual Software Upgradation charge and that is INR 2400.

Service Charges to Use Standard Plan

- The setup cost is Zero.

- Domestic Credit Cards (VISA, Mastercard, Maestro, RuPay) fee is 2.1%.

- 100+ debit cards access. The fee is 1.25%.

- Net banking with 50+ banks. The fee is 2%.

- TDR to access 9+ wallets is 2.2%.

- TDR to access major bank’s EMI options is 2.35%.

- 2% TDR for bank’s IMPS.

- TDR for International Credit cards (VISA, Mastercard) is 4%.

- TDR for American Express/Amex EMI, JCB and Diners Club is 3%.

Service Charges to Use Enterprise Plan

- The setup cost is INR 5000.

- Domestic Credit Cards (VISA, Mastercard, Maestro, RuPay) fee is 2%.

- 100+ debit cards access. The fee is 0.75% for transaction less than INR 2000. 1% for transaction greater than INR 2000.

- Net banking with 50+ banks. The fee is 1.8%.

- TDR to access 9+ wallets is 2 %.

- TDR to access major bank’s EMI options is 2.15%.

- 80% TDR for bank’s IMPS.

- TDR for International Credit cards (VISA, Mastercard) is 3.75%.

- TDR for American Express/Amex EMI, JCB and Diners Club is 2.85%.

Note: All the data presented here are on the basis of the current statistics.

Key Features of Atom Paynetz

Here come some the key features of Atom Paynetz.

- Integrated dashboard to monitor real-time transaction.

- iFrame which is a Paynetz feature that is used to display content from another source into a web page.

- International card acceptance.

- No withdrawal fees.

- Multi-currency is not supported.

- The settlement is done generally in 2 days.

- The chat facility is not good and neither does the telephone number work. So, it would be better if you contact them through their Contact Us page.

- IVR, IPR, mGalla, Omni-Channel, POS are some of the major services provided by Atom. mGalla is a brilliant app made for merchants. One-time signup, no setup, and operational costs are some of the major features of this payment app.

- Within 5 to 6 days after submitting all the documents, the transaction starts.

- WooCommerce, PrestaShop, Magento are some of the major eCommerce CMS supported by Atom Paynetz.

- Right now, this app is only available on Android.

Major Clients of Atom Paynetz

Flipkart, Big Bazaar, Spicejet, Shoppers Stop.

6. Paytm

Over the years, Paytm has gained a significant popularity and thus, the Business Paytm model is equally reliable. SMEs can be very much benefitted with Paytm Payment Gateway. They are the leader of QR based mobile payments. Paytm works very smoothly and is one of the most user-friendly payment gateways in India for sure.

Details about Paytm

Here are all the details about Paytm.

- No maintenance charges.

- Zero setup cost.

- No AMC.

- They charge a flat commission of 0% per transaction. And, additional GST of 18%

- They support all domestic debit and credit cards.

- Net banking of over 50 banks.

- Only INR is supported right now. Multi-currency transaction or support, none is available at the time of writing.

- No Withdrawal fees.

- International credit cards are not supported.

- All the settlement is made to the bank account within Transaction date +1 day. The first settlement may take 4 to 5 working days.

- Customer support is excellent. They are available throughout the week.

- Bank account details and business registration related documents are needed. Within 2 days after submitting, you can go live with your Paytm Payment Gateway.

- It gives plugins for major E-Commerce platforms namely Magento, OpenCart, PrestaShop, CS-Cart, WooCommerce, WordPress etc.

- The server site utilities are PHP, Java, Python, Ruby on Rails, ASP.NET, Express, Google App Engine, Perl, and Node.Js.

- Right now, Paytm app is available on Android and iOS.

7. PayUbiz

This payment gateway is actually a lite service from the PayU payment gateway. This gateway is a part of Naspers, a brand which is quite reputed in the international stock exchange markets.

The plans they are offering at the time of writing are Start Up, Silver, Gold, and Platinum. The integration fee is variable for different plans. In fact, the transaction fee is variable too for different transactions. Right now, all the plans have been fixed annual maintenance charge and that is INR 2400.

Features of Start Up and Silver Plan

Start Up and Silver Plans come with the following features:

- Domestic Credit Card and Net banking

- Debit Card (Mastercard, VISA, Maestro, RuPay)

- AMEX Cards, Diners Cards, and Cash Cards

- 5+ Wallets options

Features of Gold and Platinum Plan

Gold and Platinum Plans come with the following features:

- All the above features

- International Credit Cards

- EMI options

Now, we will discuss some general pros and cons of PayUbiz which can be the decisive factors of availing the payment gateway.

Pros of PayUbiz

- Withdrawal fees zero

- Accepts payments with UPI.

- It supports around every major CMS systems.

- The dedicated mobile app can be integrated with Android, Windows, and iOS.

- Supports REST API 2.1 protocol.

Cons of PayUbiz

- It does not support Multi-currency.

- Customer support is not as per excellence.

- It takes around 5 to 7 days to start a transaction.

Major Clients of PayUbiz

Snapdeal, Zomato, Redbus, Bookmyshow, Ola, Jabong.

An interesting thing is that recently Citrus Payment Gateway was merged with PayU.

8. Mobikwik Payment Gateway

There was a time when Mobikwik was a household name for online mobile recharge. With its rising popularity and usage, Mobikwik has also become one of the most famous payment gateways in India within no time.

Right now, Mobikwik is offering two plans which are Small Business/Startups and Enterprise. Below is the description of the two plans.

Small Business/Startups

Companies registered less than 3 months ago can be listed in this category.

- TDR is free for the first 15 days.

- After that, 1.9% plus GST per transaction for domestic credit cards, debit cards, UPI, net banking, wallets.

- For International credit card, EMI, AMEX, Diners – the rate is 2.9% plus GST

- To know the setup and maintenances charges, merchants can request a demo.

Enterprise

- All the above features are available. Though the charges are custom and negotiable.

Now, we will move ahead to the features of Mobikwik which can increase your payment experience.

Key Features of Mobikwik

The key features of Mobikwik are as follows:

- No withdrawal fees.

- Mobile friendly (Auto-fill OTP) and mobile-optimized checkout design.

- Seamless integration and developer friendly. It supports WordPress, Magento, Java, PHP, OpenCart, and Asp.Net.

- Secure and best conversion rates.

- Transaction date+2 days for settlement.

- Mobile App integration for Android, iOS, and Windows

Major Clients of Mobikwik

Zomato, UBER, Domino’s, Instamojo, Blue Dart, Ease My Trip.

All these features make Mobikwik one of the best payment gateways available in India. So, you can give it a try as it comes in the top 10 list of the payment gateways.

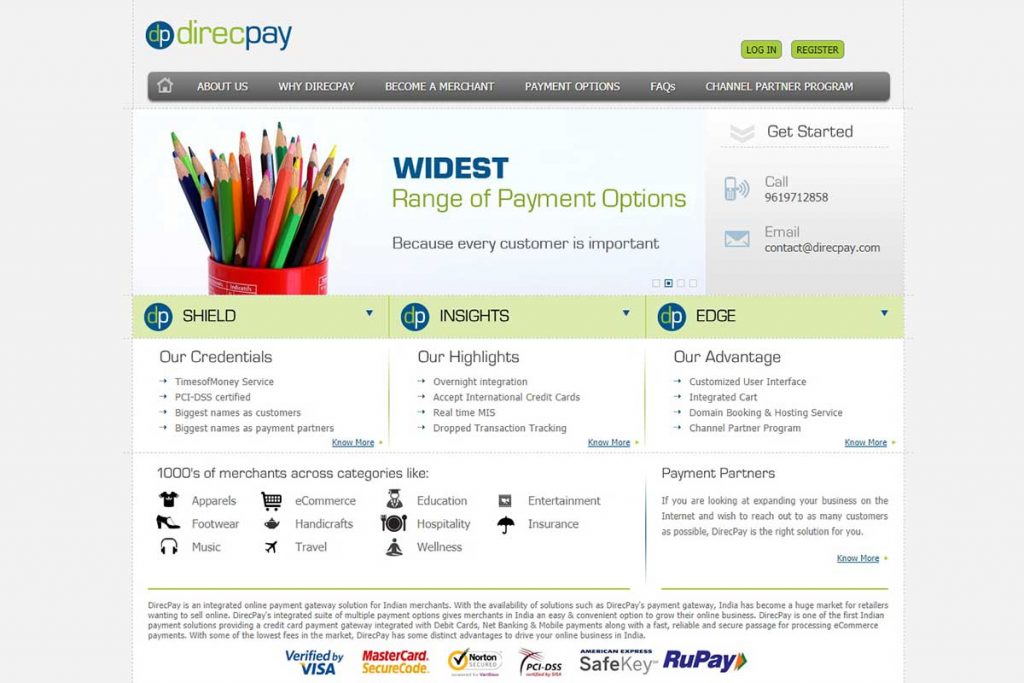

9. DirecPay

DirecPay is one of the largest and leading payment gateways in India. Merchants can get cost-effective plans, wide payment methods, and a secure technology platform through this gateway.

Currently, DirecPay is offering two services. One is a Free plan and the other one is Corporate.

Pricing and TDR for Free Plan

The whole pricing and TDR for the Free Plan are as follows.

- Free set up.

- AMC is Free too.

- TDR for debit cards is 1.25%.

- TDR for Mastercard and VISA is 2.5%. TDR for AMEX 3%.

- For Net banking, the rate is 2.5%

Pricing and TDR for Corporate Plan

The pricing and TDR for the Corporate plan are as follows.

- The setup cost is INR 5000.

- AMC is INR 2400.

- TDR for debit cards is 1.25%.

- TDR for Mastercard and VISA is 2 %. TDR for AMEX 3%.

- For Net banking, the rate is 2%

Key Features of DirecPay

The key features of DirecPay are as follows. These are the awesome features which can let you have a nice experience during the transaction.

- International card support is subject to additional payment of a refundable security money.

- Multi-currency support.

- No Withdrawal fees.

- Transaction date + 2 working days are required for settlement.

- Except for weekends, customer support is excellent throughout weekdays.

- Business registration documents are required.

- 5 to 7 days are required to start a transaction.

- DirecPay can be integrated with all major shopping carts namely Joomla, CubeCart, Magento, CS-Cart, PrestaShop, OpenCart etc.

- At this point, the mobile app of DirecPay is available for Android and iOS.

10. HDFC Payment Gateway

In spite of the fact that HDFC is one of the leading banks in India, we have included it in the 10th position on the list. Actually, this payment gateway is not for small businesses. If you have a large organization and good flow of cash, you can always take advantages of this gateway.

Right now, it is one of the best payment gateways in India for big ventures and offering two services which are Business-to-Business and Direct Pay Mode of Payment.

Key Features of HDFC Payment Gateway

Coming to the major features of this gateway and here it goes.

- Instant settlement.

- It accepts payment in 15 international currencies.

- They chargeback 100% which is one of its kind.

- It supports a number of major shopping carts. All Master or VISA credit cards and debit cards plus Net baking are also supported by HDFC Payment Gateway.

- The setup cost is INR 20,000 + service tax (this is a one-time and non-refundable amount).

- Transaction cost for credit or debit card varies between 3%-10% plus service tax.

- AMC is INR 10,000 every year.

- No Minimum Annual Business requirement.

- Payment is only credited to the current account of HDFC. It takes Transaction date+1 day.

- The multi-currency support that supports 16 countries.

- No Withdrawal fees.

- Excellent customer support.

- Bank account details are required for documentation.

- It takes quite a lot of time to initiate the transaction. The verification and audit process take time longer than usual. So, they issue everything only when they feel everything is alright.

- It supports major eCommerce systems like OpenCart, CS-Cart, PrestaShop, WordPress etc.

- Right now, HDFC is available on Android, iOS, and Windows.

So, that was all about a comprehensive list of payment gateways in India. While choosing the best for your consumers, always keep in mind at least two payment gateways. Team Intlum is always trying to give the best support to their consumers. If you have are an owner and looking for an urgent help regarding payment gateways, then we want to assure you that Intlum can help you to incorporate your choice of payment gateway on your site. Trust us and be assured.

No comments:

Post a Comment